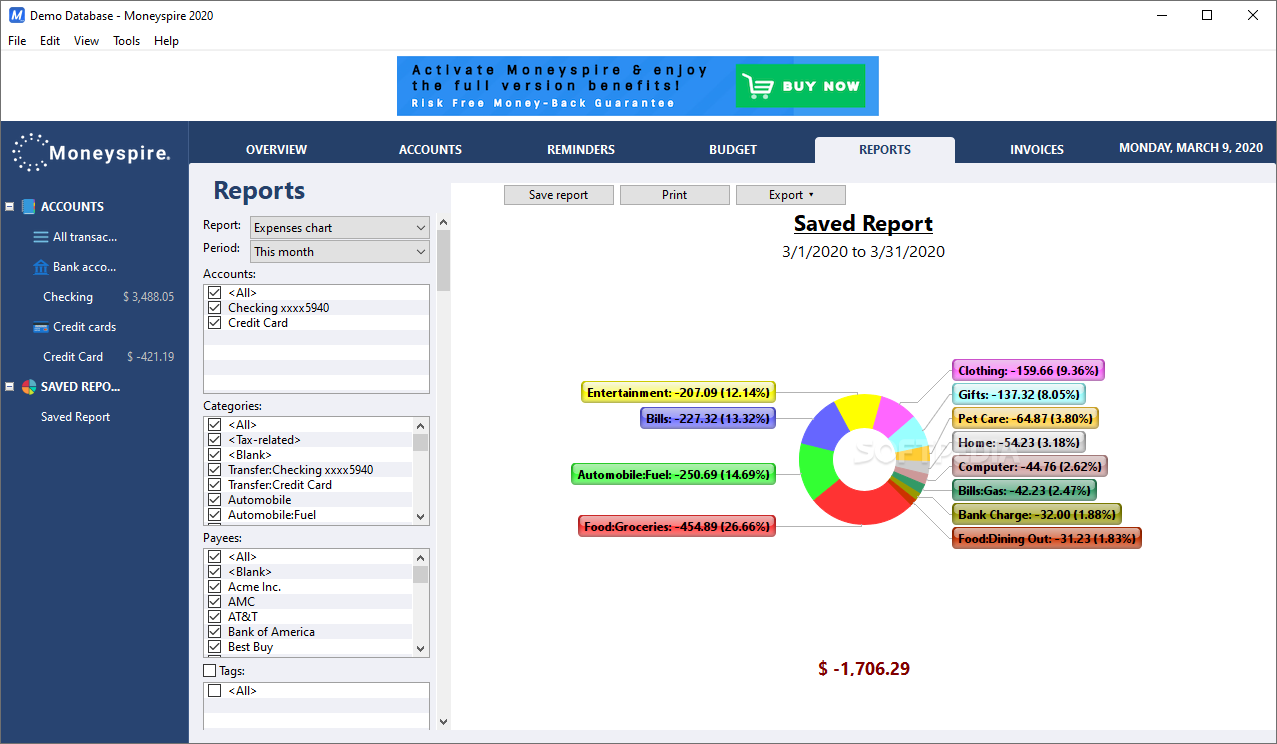

Moneyspire provides a handy way to manage one's expenses. Features include: A clean easy-to-use interface, split transactions, reconciliation, investment account support, multiple currency support, Direct Connect with Online Bill Pay, check printing, QIF, QFX, OFX and CSV file import. You can even set reminders, which is useful for keeping track of bills and loans, and managing invoices is also possible through the designated tab. Monthly expenses, balance sheets, income vs expense, and other such reports will help you better recognize and manage your spending habits. Reports for your spendingĪs you add your expenses into the program, reports will be automatically generated to reflect your spending habits. As you introduce and assign your spending to the appropriate sources, you'll be able to see an overview for everything, neatly nested in the Accounts tab.

Whether it's a transfer, ATM withdrawal, deposit, or print check, you can add it all here. investment account support, multiple currency support, Direct Connect with Online Bill Pay, check printing, QIF, QFX, OFX and CSV file import, and more. You can specify as many or as few details you want about them: the transaction type and category, payee, withdrawal and deposit amounts, as well as attach a memo and tag everything. You don't have to enter any sensitive details about anything, and you can even link up parent accounts and attach notes to what you add.Īfter adding your accounts, it's time to add the transactions. It's important to state the type of the account: checking accounts, credit cards, cash, loans, assets, liabilities, and investments can be tracked through the app. The interface is intuitive, and you can begin by adding a new account.

Moneyspire and check printing software#

A modern tool for modern spendingĪs the software seeks to provide a way for users to manage their money, it's quite an accessible, easy-to-navigate program, which means that anyone can leverage the tool's functionality. The tool allows users to add their bank accounts, track their spending, look through their transactions, and break everything down into reports to better visualize their expenditures. Software like Moneyspire, however, was expressly conceived for the sole purpose of helping people manage their money. While online banking does provide people with ways to track their spending, it's usually not something that can lead to sustainable and responsible spending. Managing your money is an important part of life, and having software by your side to help you with the process can be of great aid.

0 kommentar(er)

0 kommentar(er)